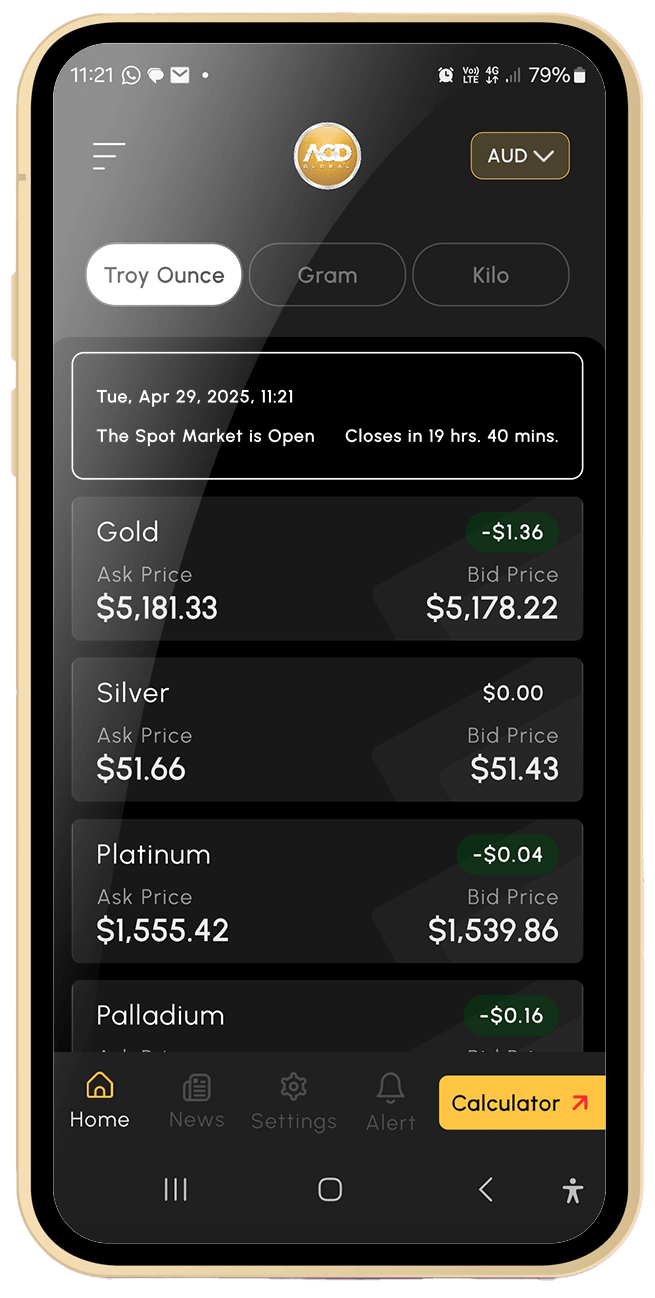

Track live, real-time spot prices and stay ahead of the market.

Download the LIVE GOLD PRICE APP now!

The Spot Market is OPEN. CLOSE in 5 hrs. 42 mins.

Gold

+ A$ 14.55

Ask Price A$ 7,303.31

Bid Price A$ 7,300.50

Silver

+ A$ 0.47

Ask Price A$ 127.15

Bid Price A$ 126.94

Platinum

+ A$ 17.01

Ask Price A$ 3,251.56

Bid Price A$ 3,237.50

Palladium

+ A$ 3.19

Ask Price A$ 2,558.85

Bid Price A$ 2,502.61

AGD Global provides customers with greater choice and flexibility when trading precious metals. As one of Australia's most respected gold buyers and traders, we offer competitive prices for your unwanted items.

We cater specifically to pawnbrokers, coin shops and second-hand dealers, offering a range of services, including scrap refining, purchasing unwanted jewellery and buying all forms of precious metals.

"We specialise in working with businesses and trade professionals, delivering customised solutions tailored to industry needs. Our services are exclusively designed for registered companies and are not available to the general public."

We offer competitive rates for buying a wide variety of precious metals, including:

(Kitco News) – Gold and silver prices are higher near midday Wednesday, with silver once again leading the way with solid gains and scoring a three-week high.

(Kitco News) – After a parabolic move earlier this year, silver prices have entered a consolidation phase — but the broader bull case, supported by robust retail demand, remains intact, according to one fund manager.

(Kitco News) – The spot gold price will rise an additional 22% from current levels by the end of 2026, according to the latest forecast from commodity analysts at J.P. Morgan.In a note published Wednesday morning, J.P. Morgan analysts said strong and sustained demand from both central banks and investors through 2026 will ultimately push gold prices to $6,300 per ounce by year-end.The investment bank also raised its long-term price forecast for the gold to $4,500 per ounce.

Copyright © 2026 AGD Global