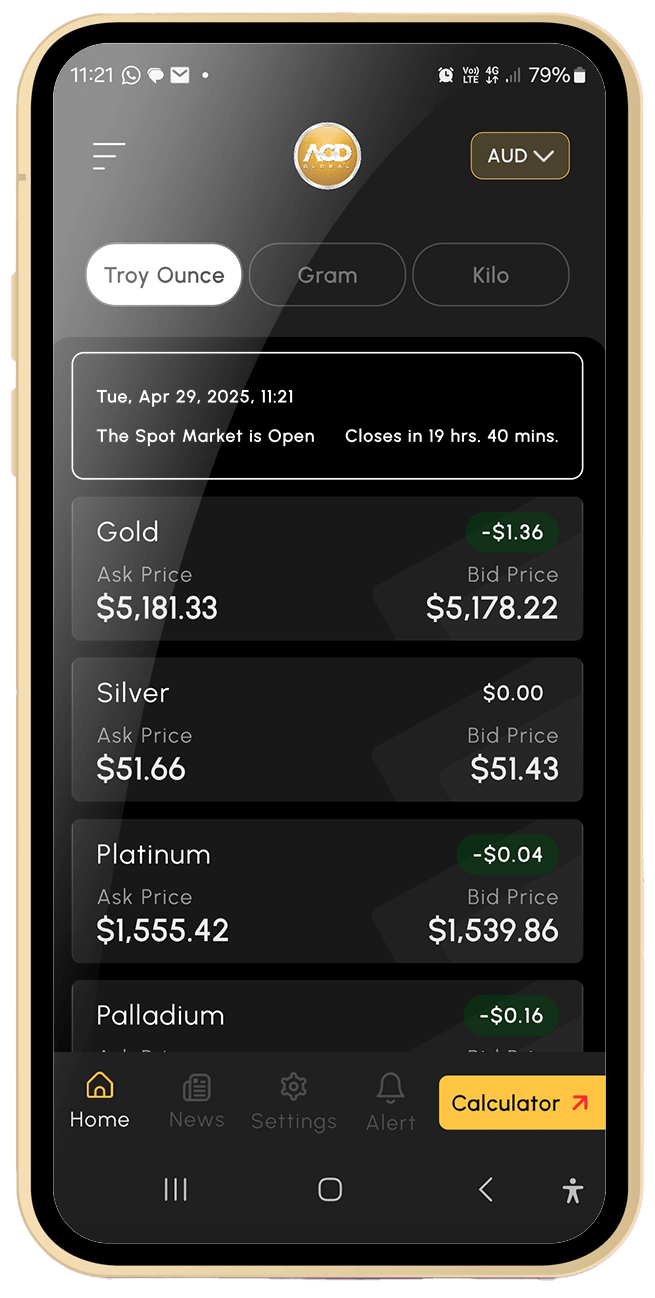

Track live, real-time spot prices and stay ahead of the market.

Download the LIVE GOLD PRICE APP now!

The Spot Market is OPEN. CLOSE in 1 hrs. 16 mins.

Gold

+ A$ 5.83

Ask Price A$ 7,256.38

Bid Price A$ 7,253.56

Silver

+ A$ 0.85

Ask Price A$ 122.15

Bid Price A$ 121.94

Platinum

- A$ 11.17

Ask Price A$ 3,108.75

Bid Price A$ 3,094.61

Palladium

+ A$ 6.94

Ask Price A$ 2,414.29

Bid Price A$ 2,357.75

AGD Global provides customers with greater choice and flexibility when trading precious metals. As one of Australia's most respected gold buyers and traders, we offer competitive prices for your unwanted items.

We cater specifically to pawnbrokers, coin shops and second-hand dealers, offering a range of services, including scrap refining, purchasing unwanted jewellery and buying all forms of precious metals.

"We specialise in working with businesses and trade professionals, delivering customised solutions tailored to industry needs. Our services are exclusively designed for registered companies and are not available to the general public."

We offer competitive rates for buying a wide variety of precious metals, including:

(Kitco News) – Despite gold’s recent disappointing price action, as the precious metal has been unable to hold a safe-haven bid, it continues to attract strong investor interest due to broader geopolitical tensions and shifting macroeconomic conditions, according to the World Gold Council.

(Kitco News) – After breaking its five-week winning streak last week, investors still see gold as an essential alternative to fiat currencies but don’t see the earlier momentum, and restoring the historical correlation between oil and gold will require either significantly higher oil or lower gold prices, according to Bob Savage, head market strategist at BNY.

(Kitco News) – Gold prices are lower near midday Monday, on increasing marketplace worries that the war in Iran will cause global stagflation that includes higher interest rates.

Copyright © 2026 AGD Global