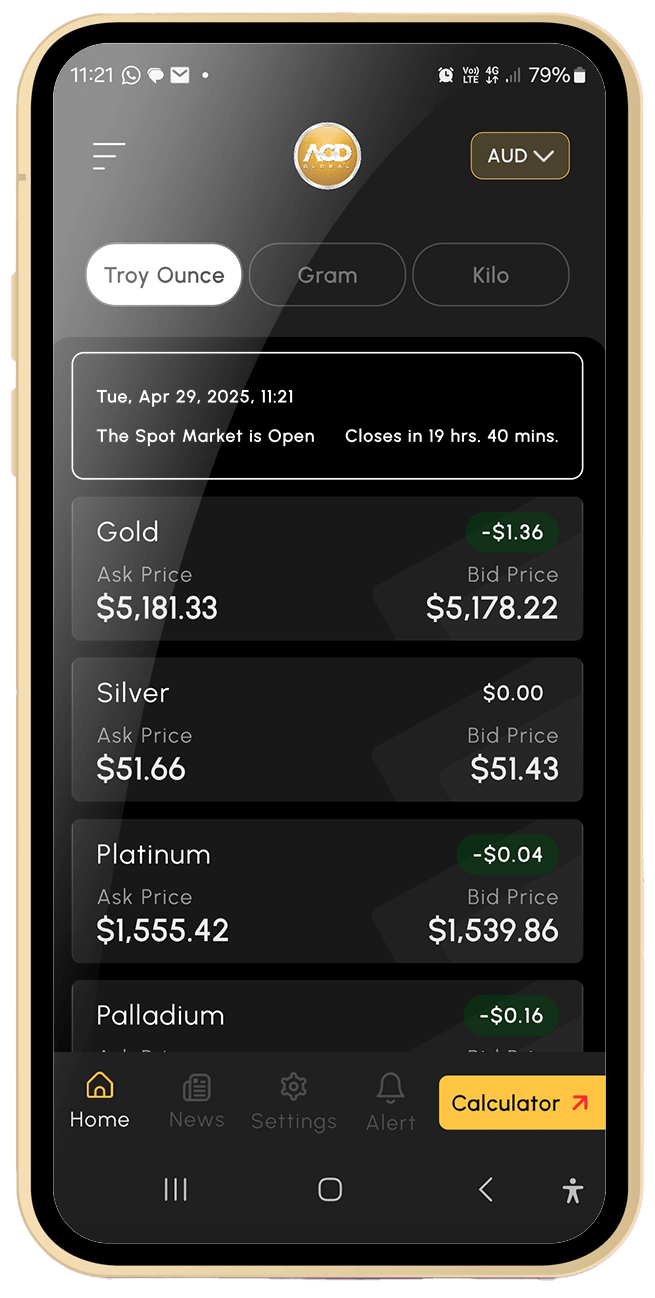

Track live, real-time spot prices and stay ahead of the market.

Download the LIVE GOLD PRICE APP now!

The Spot Market is OPEN. CLOSE in 0 hrs. 9 mins.

Gold

- A$ 2.29

Ask Price A$ 7,095.47

Bid Price A$ 7,092.61

Silver

+ A$ 0.15

Ask Price A$ 125.95

Bid Price A$ 125.74

Platinum

+ A$ 7.23

Ask Price A$ 3,200.84

Bid Price A$ 3,186.55

Palladium

- A$ 11.53

Ask Price A$ 2,559.37

Bid Price A$ 2,502.22

AGD Global provides customers with greater choice and flexibility when trading precious metals. As one of Australia's most respected gold buyers and traders, we offer competitive prices for your unwanted items.

We cater specifically to pawnbrokers, coin shops and second-hand dealers, offering a range of services, including scrap refining, purchasing unwanted jewellery and buying all forms of precious metals.

"We specialise in working with businesses and trade professionals, delivering customised solutions tailored to industry needs. Our services are exclusively designed for registered companies and are not available to the general public."

We offer competitive rates for buying a wide variety of precious metals, including:

(Kitco News) – Gold and silver have seen a solid bounce off their Monday lows; however, one market analyst is warning investors that there is more downside potential, as last week’s record highs could signal a top in the market.

(Kitco News) – While high prices saw sovereign buying tail off somewhat toward the end, central banks in 2025 still finished not far from the prior year in tonnage terms, according to Marissa Salim, Senior Research Lead, APAC at the World Gold Council.”Central banks bought 19t of gold in December 2025 via the IMF and other public data sources, bringing full-year 2025 reported net purchases to 328t,” Salim announced on Tuesday. “This is lower than the 345t of net purchases recorded in 2024.”

(Kitco News) – Volatility in the precious metals remains elevated as the market trades around key psychological levels and tries to find some stability after two days of sharp selling pressure.

Copyright © 2026 AGD Global