Track live, real-time spot prices and stay ahead of the market.

Download the LIVE GOLD PRICE APP now!

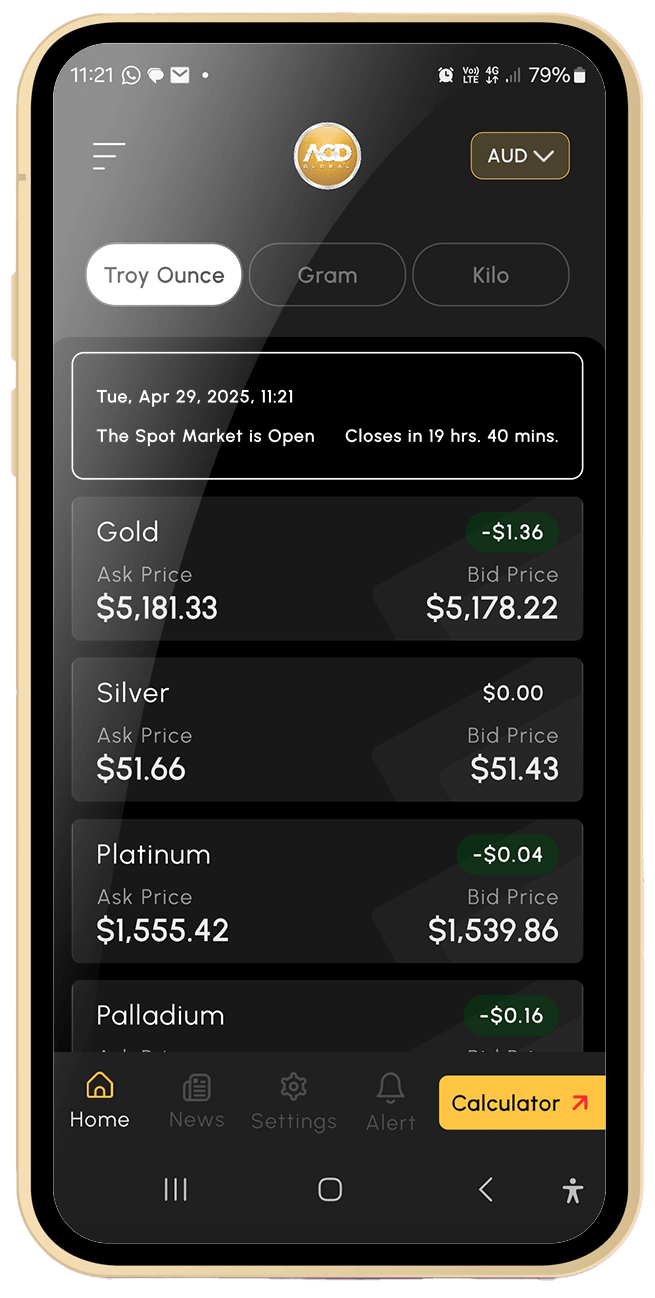

The Spot Market is OPEN. CLOSE in 1 hrs. 42 mins.

Gold

+ A$ 0.23

Ask Price A$ 6,662.99

Bid Price A$ 6,659.98

Silver

+ A$ 0.12

Ask Price A$ 103.34

Bid Price A$ 103.12

Platinum

+ A$ 6.93

Ask Price A$ 3,167.81

Bid Price A$ 3,152.78

Palladium

- A$ 0.31

Ask Price A$ 2,677.47

Bid Price A$ 2,617.38

AGD Global provides customers with greater choice and flexibility when trading precious metals. As one of Australia's most respected gold buyers and traders, we offer competitive prices for your unwanted items.

We cater specifically to pawnbrokers, coin shops and second-hand dealers, offering a range of services, including scrap refining, purchasing unwanted jewellery and buying all forms of precious metals.

"We specialise in working with businesses and trade professionals, delivering customised solutions tailored to industry needs. Our services are exclusively designed for registered companies and are not available to the general public."

We offer competitive rates for buying a wide variety of precious metals, including:

(Kitco News) – Tariff uncertainty and strong demand from ETFs and central banks drove gold prices to record highs above $4,000 per ounce in 2025, and new demand from Chinese insurance giant and the crypto community could help the yellow metal break above $5,055 by the end of 2026, according to J.P. Morgan.After a year of the explosive demand and unprecedented price gains, J.P. Morgan’s 2026 outlook calls for the bull market to continue as the key drivers remain strong.

(Kitco News) As U.S. equity markets close out 2025 near record highs, Bloomberg Intelligence Senior Commodity Strategist Mike McGlone says markets are sending conflicting signals that point to a volatile reset in 2026 rather than a smooth continuation …

(Kitco News) Gold’s successive all-time highs in 2025, silver’s surge to levels last seen decades ago, and another year of heavy central bank buying have pushed the precious metals market into what Ronald Peter Stöferle believes is its next acceleration phase.

Copyright © 2025 AGD Global