Track live, real-time spot prices and stay ahead of the market.

Download the LIVE GOLD PRICE APP now!

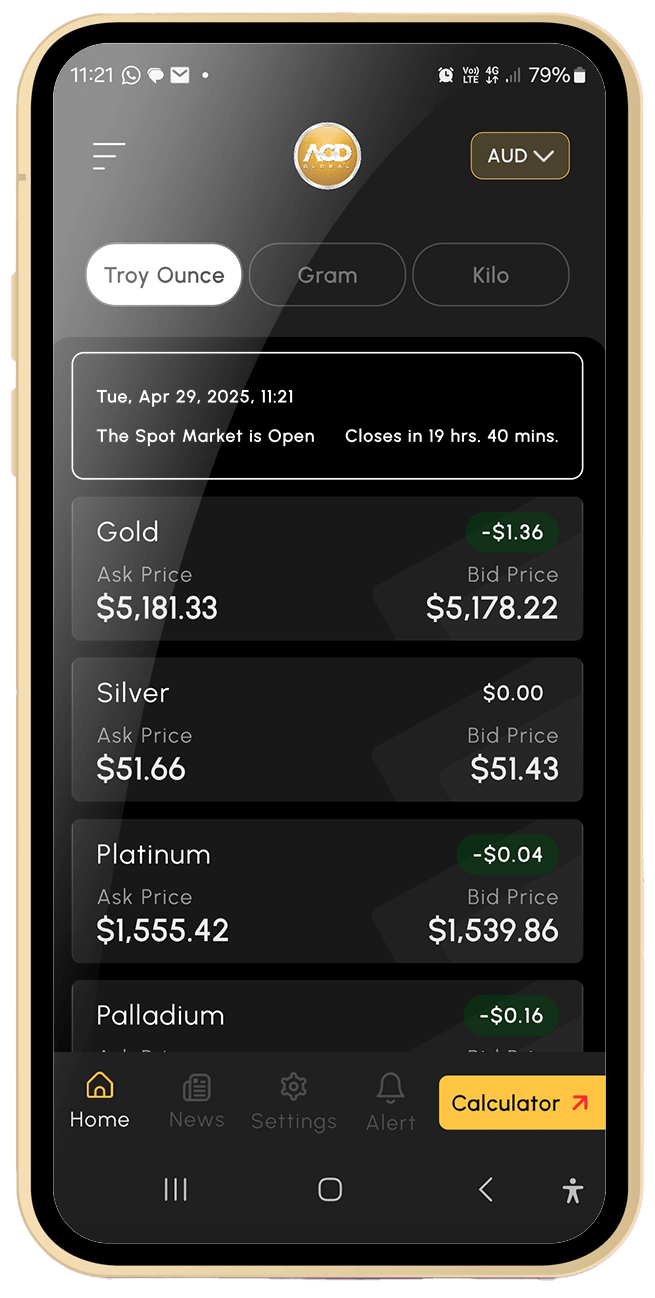

The Spot Market is OPEN. CLOSE in 22 hrs. 38 mins.

Gold

+ A$ 15.67

Ask Price A$ 6,703.69

Bid Price A$ 6,700.70

Silver

+ A$ 0.19

Ask Price A$ 107.11

Bid Price A$ 106.88

Platinum

+ A$ 8.67

Ask Price A$ 3,482.42

Bid Price A$ 3,467.50

Palladium

+ A$ 3.15

Ask Price A$ 2,839.96

Bid Price A$ 2,780.27

AGD Global provides customers with greater choice and flexibility when trading precious metals. As one of Australia's most respected gold buyers and traders, we offer competitive prices for your unwanted items.

We cater specifically to pawnbrokers, coin shops and second-hand dealers, offering a range of services, including scrap refining, purchasing unwanted jewellery and buying all forms of precious metals.

"We specialise in working with businesses and trade professionals, delivering customised solutions tailored to industry needs. Our services are exclusively designed for registered companies and are not available to the general public."

We offer competitive rates for buying a wide variety of precious metals, including:

(Kitco News) – While Bitcoin, AI and the tech sector are likely to take a step back in 2026, gold’s bull run still has legs – and crypto’s weakness could add to silver’s strength, according to Charlie Morris, CIO and founder of ByteTree.ByteTree created the BOLD Index, which blends Bitcoin and gold on a risk-weighted basis, and the 21Shares BOLD ETP (BOLD) which tracks the index is listed across Europe. The theory behind the BOLD index is that gold and Bitcoin are uncorrelated alternative assets, so balancing between them is very advantageous.

(Kitco News) – Gold and silver prices are posting gains in midday U.S. trading, and hit record highs earlier today. Gold did back well down from its daily high following a stronger U.S. GDP report.

(Kitco News) – Gold prices fell into negative territory after the latest data showed U.S. consumer sentiment declining more than expected this month.The Consumer Confidence Index fell to 89.1 in December, below economists’ consensus forecast for a 91 reading and also down from the upwardly revised 92.9 print from November, the Conference Board announced on Tuesday.

Copyright © 2025 AGD Global